The Kingfisher’s Liq Maps fundamentals

A deeper look into liquidations and using liq maps

The Kingfisher’s Liq Maps fundamentals

Background

Traders on unregulated exotic derivatives exchanges expose themselves to additional risk. The Liquidation risk.

When a trader’s position’s liquidation price hits, his entire position will be routed through the exchange’s risk engine to cover the trader’s loss.

When only a few positions worth a few bitcoins are concerned, the market impact is negligible. If hundreds of such positions have liquidation prices close to each other, the closing orders compound, and the market impact can be massive. Furthermore, a liquidation can trigger another one by pulling the price just enough and might trigger “mass chain liquidations” across several hundreds of dollars.

The Kingfisher Liq Maps

The Kingfisher is the only service showing you areas where a high density of liquidations will take place.

Those are price zones of high liquidity, fast price action, and general confusion for those not expecting them.

By using The Kingfisher’s liquidation maps, you can

- Breakout trade

- Profitably scalp

- Accurately place your stop-loss and save yourself from a stop hunt

- Take-profit in areas of high liquidity

- Optimise significant size execution, finding liquidity, and avoiding unnecessary slippage.

- Detect when volatility events like sudden pump/dump will start and fade.

How to read the liquidations maps

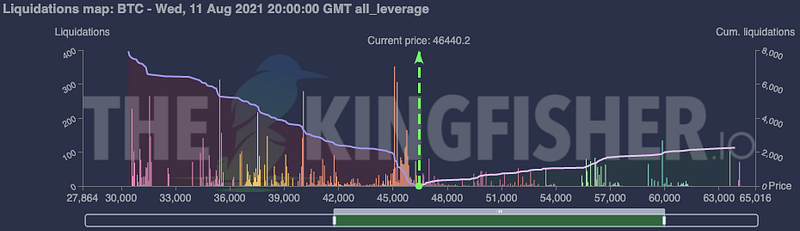

The Kingfisher’s Liquidation Maps (aka. liq maps) offer a global view of the Futures crypto markets’ participants' liquidations. It only shows upcoming liquidations, based on previous price action.

What do the axis represent?

The X-axis represents the asset’s price, while the Y-axis shows the relative strength of the liquidations.

Rather than showing the exact number of liquidations, or exact volumes, the relative strength shows the importance of each liquidation level relative to each other. Hence, it shows how significantly the market will be locally impacted by the liquidations present there. A higher “liquidation bar” will imply that the price will react in a stronger way to the surge in liquidity

Note: Currently, the colors are only meant to help the user read out the different clusters of liquidations. The colors don’t have additional information within them.

Liquidations maps exist in different flavors. Each corresponds to different timeframes and different “mixes” of leverages.

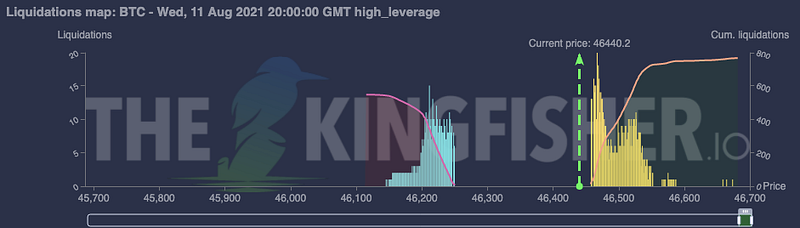

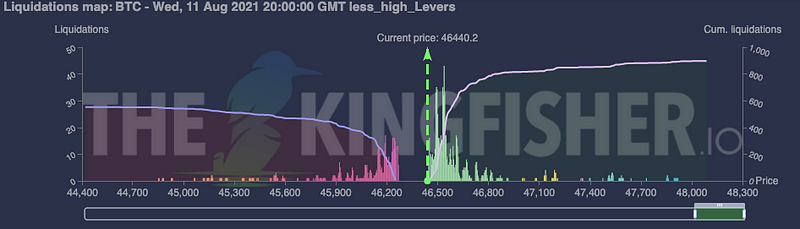

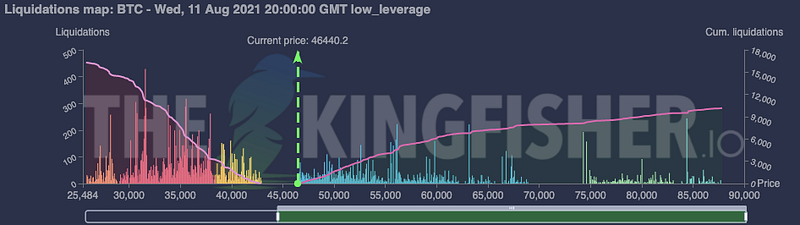

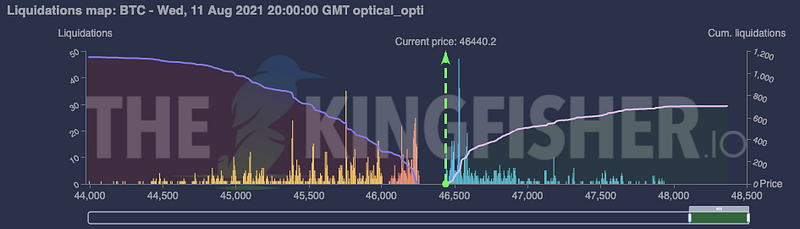

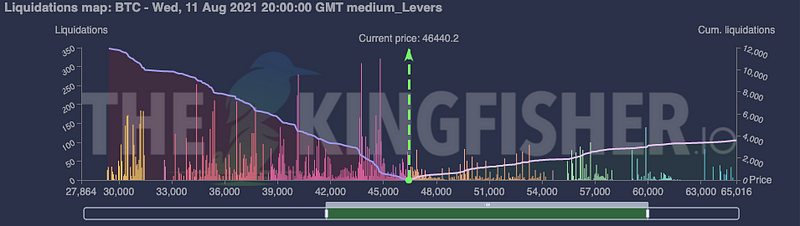

As you can see below, different mixes in leverage and timeframes paint several liquidations clusters. The denser and taller the liquidation cluster, the bigger the impact will be on the price action when it reaches it.

All_leverage

High_leverage

Less_high_levers (for lack of better term)

Low_leverage

Optical_opti

This configuration is still experimental. It was built to mimic the way cameras auto-focus. It gives an interesting short term view of the market’s liquidations

Medium_leverage

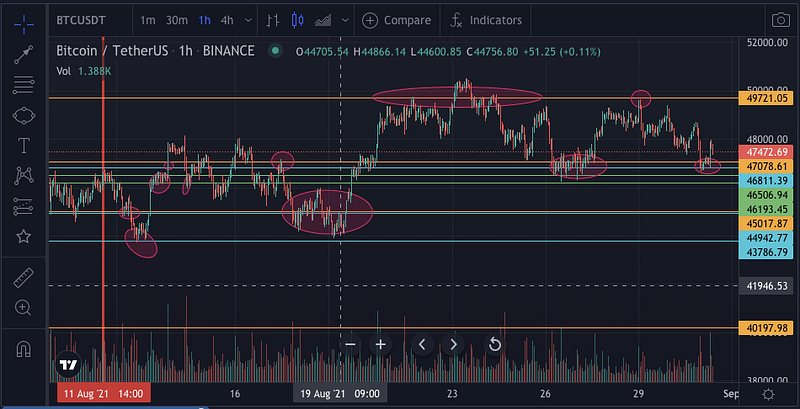

Looking at relatively short-term price action, one can observe on the below graph that significant liquidations clusters usually imply significant moves/reversal of the price action when reaching those clusters.

- Vertical red line: Timestamp at which each of the previous liq maps were pulled

- Horizontal green: High leverage liq maps

- Horizontal orange: All leverages liq maps

- Horizontal blue: Medium leverages liq maps

Note that of course, refreshing liq maps regularly, especially the higher leverages, allows you to much more accurately target liquidation clusters, and precisely time your execution.

You can also notice that not all liquidation clusters will hit within a given timeframe. For example, the large 40k cluster on the graph below might never get hit or get cleared much later on. Many of those clusters tend to pile up and help to generate mass liquidations events, during which the Bitcoin price can retrace a few dozen percent.

Going further, it is interesting to note a few things about liquidations:

- There are more Apes than you think, Kingfishers are here to collect

- The price action tends to be attracted to clusters of denser liquidations

- Liquidations tend to mark local tops and bottoms

To get started on thekingfisher.io, check out the guide. And join us on Twitter or Telegram for any questions or further liquidations analysis and discussions!