Document not found, overwrite this content with #not-found slot in <ContentDoc>.

Elevate Your Trading Game

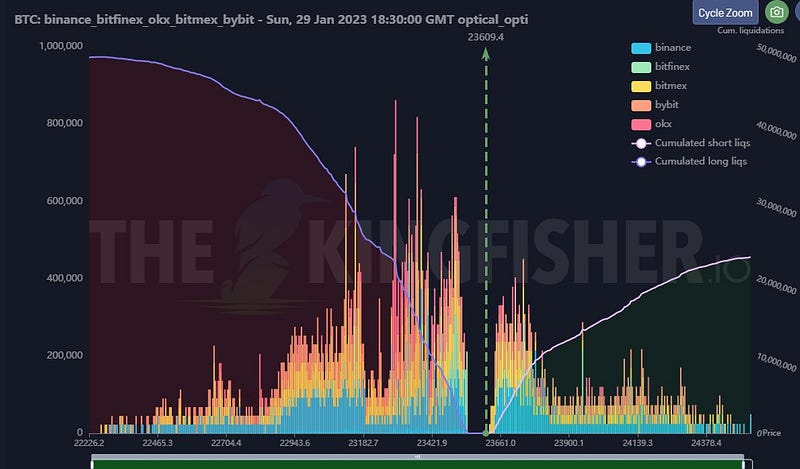

Get Exclusive Access to Cutting-Edge Crypto Data with The Kingfisher!

Author

The Kingfisher

The Kingfisher, a trailblazer in liquidation forecasting and algorithmic trading, is renowned for providing insightful and groundbreaking Liquidations maps and custom data. Dedicated to sharing valuable knowledge and strategies, The Kingfisher team empowers their members to evolve and succeed in the dynamic world of trading