The Kingfisher: Your scalping toolbox

The all-in-one tool you’ll need for scalping

The Kingfisher: Your scalping toolbox

The all-in-one tool you’ll need for scalping

Liquidation maps

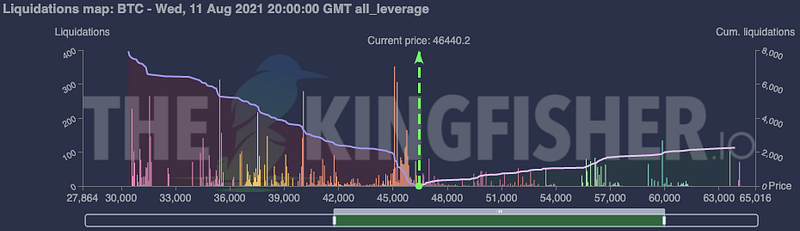

The Kingfisher’s unique Liquidation Maps helps visualize where the hidden “liquidation liquidity” is. When a trader opens a leveraged position, it will come with a liquidation price which, once hit, will trigger an automated market order to close the position. Or gradually deleverage when coming close to this price.

The Kingfisher maps those liquidation prices across the whole market, giving a global vision of where some of the hidden liquidity is.

Overlaid BTC Liquidation Map

Standalone liquidation map

Toggle between overlay (BTC) and Standalone

Funding rate

Studying the funding rate can help predict upcoming high volatility. Given the impact of funding rate on traders’ balance for leverage trading, high levels of funding rate around settlement time might reduce a trader’s available margin and in turn bring one’s liquidation price closer.

If a trader is already overleveraged, this will induce a partial or complete liquidation of his position to cover the funding payment.

Some traders might prefer closing their position early, to avoid the funding payment, and re-open it later on.

Of course, the bigger the funding, the bigger the impact…

Historical funding rate

Live funding rate

Live open interest variation

The open interest allows the measurement of contracts that have been opened within futures markets.

The variation of Open Interest vs the underlying Price Action can help identify the strength of a trend. - Increasing OI → The trend tends to become stronger - Decreasing OI → The trend is losing strength

Long /short ratio

The long vs short ratio gives valuable information as to how a majority of traders position themselves at any moment in the market. The Kingfisher tracks the Bitcoin position ratio over the major exchanges.

Note: The Long/Short ratio combined with liquidation zones (given by the Kingfisher maps) and the funding rate evolution, tends to give very actionable and profitable trading signals

Liquidation calculator

Using the calculator, you can quickly and easily figure out relevant liquidation prices.

How to use it: - Toggle between Long and Short sides - Enter an entry price manually, click on the graph to automatically change it (taking the selected close price), or click the green arrow buttons to quickly update it.

The Kingfisher Calculator

Candle exhaustion indicator & CVD

The Kingfisher candle exhaustion indicator (major/minor long/short) signals tells a lot about the state of the current trend, and especially when it loses momentum and ends.

That and the CVD (Cumulative Volume Delta) can help one precisely understand how the buying/selling volume is being absorbed (or not) by the traders on the other side of the book. This in turns can help identify the strength of different price action scenario, as they’re playing out.

Note: Play on the <1 min timeframe for great scalping opportunities

Conclusion

The Kingfisher strives to bring to the market the essential trading and scalping tools. No unnecessary Bollinger Bands, no complicated and subjective Elliott waves or other trend/support/resistance drawing tools.

Only actionable data, for easy and effective trading and scalping. A crazy amount of alpha hides within the Liquidation Maps.

An article focused on Liquidations maps will follow…